Working Thesis

We believe that the cost saving and value creation opportunities associated with blockchain are so compelling that we are entering a prolonged period of rapidly escalating demand for enterprise-grade production applications.

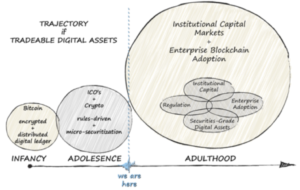

We’ve entered an era where secure / tradable digital assets have become technically sound and financially compelling. The dual allure, of broad enterprise adoption and the creation of a new asset class for secure / tradable digital assets, has caused capital markets around the world to increase activities related to blockchain technologies and tradable digital assets.

Increasingly, open digital solutions make it possible for people or companies to offer solutions to specialized financial services without a need to gain access to the legacy financial systems or the services provided by traditional financial services firms. As these alternative technology options have matured, fintech innovation has accelerated, increasing the number of ‘apps’ and services that consumers can choose from.

In our view, the digital disruption of traditional financial services firms is unstoppable.

Capital Markets

Capital markets strive to stay ahead of the adoption curve for major trends (but not too far ahead). Blockchain is one of the most promising new areas for investment, because it promises to both disrupt enterprise and unlock new value.

Rapid growth in evaluation projects plus the lure of securitizing digital assets and related investor demand has already prompted capital markets around the world to increase activities related to using blockchain and underwriting blockchain projects. The level of credibility as well as the overall size of the opportunity will become significantly more attractive as evidence of successful projects mounts (enterprise evaluations + disruptive competitors).

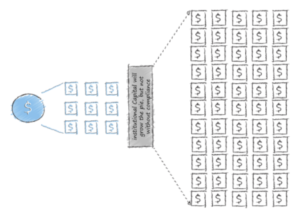

Institutional Capital will grow the pie, creating new, Alternative Pools of Capital, but not without regulations.

So What: global capital markets are already committed to engage with blockchain and the level of involvement will grow significantly over the next 3 years.

Regulation of Digital Assets

In our view the next wave of value creation will focus on doing to the flow of value what the internet revolution did to the flow of information. Distributed ledgers + smart contracts (collectively, ‘trust-tech’) will replace the trusted manual processes that currently control the movement of value between entities (people and organizations) with automated processes that follow the same rules to accomplish the same function, but do it faster, cheaper, with a lower risk of fraud.

So What: we believe that regulations are necessary for the adoption and trading of smart digital assets, which we also call programmable securities. We are currently seeing the first wave of regulation. As that matures and is tested in the courts and adopted in the markets, we anticipate a long and sustained increase in engagement of capital markets and enterprises.